|

|

| 112 E GORDON ST |

|

| KINSTON , NC 28501 |

|

| Property

Location Address |

|

| Parcel

ID No. |

13572 |

| PIN |

4525 63 33 7245 |

| |

|

| Owner ID |

1002380 |

| |

|

| Tax

District |

141 - CNTY/CTY KINSTON/MUNI SVC |

| |

| Land Use Code |

C |

| Land Use Desc |

COMM - IMP |

| |

|

| Neighborhood |

0331 |

|

| Legal

Desc |

112 E GORDON STREET |

| |

2ND FLOOR NO VALUE |

| |

|

| Deed

Year Bk/Pg |

2017 - 1799 / 771 |

| Plat

Bk/Pg |

/ |

| |

Sales

Information |

| |

| Grantor |

WOOTEN DAL F III & |

| |

TURIK ANNETTE WEBB |

| Sold

Date |

2017-04-11 |

| Sold

Amount $ |

80,000 |

|

| |

| Market Value $ |

83,824

|

| |

|

Market

Value - Land and all permanent improvements,

if any, effective January 1, 2017, date

of County’s most recent General Reappraisal

|

|

| |

|

| Assessed Value $ |

83,824

|

| |

If

Assessed Value not equal Market Value then

subject parcel designated as a special

class -agricultural, horticultural, or

forestland and thereby eligible for taxation

on basis of Present-Use.

|

|

|

| Year

Built |

1901 |

| Built

Use/Style |

OFFICE-AVG QLTY |

| Grade |

C / |

| * Percent

Complete |

100 |

| Heated

Area (S/F) |

1,903 |

| Fireplace

(Y/N) |

N |

| Basement

(Y/N) |

N |

| ** Bedroom(s) |

0 |

| ** Bathroom(s) |

0 Full Bath(s) 0 Half Bath(s) |

| *** Multiple

Improvements |

001 |

*

Note - As of January 1

*

* Note - Bathroom(s), Bedroom(s), shown for description

only

* * * Note - If multiple improvements equal “MLT” then

parcel includes additional major improvements |

|

| Building

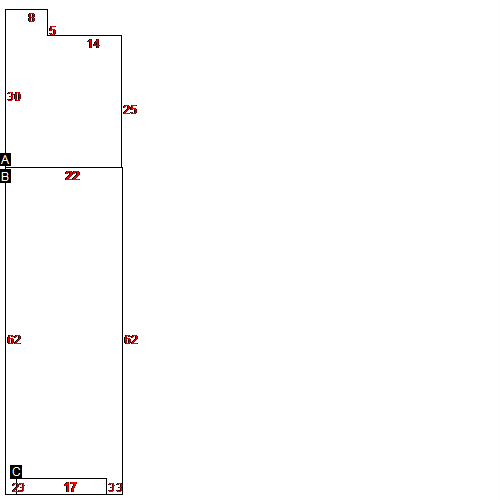

Sketch - NOTE: Sketches are updated the first day of every month. |

|

(Building 1) - Sketch for Parcel ID: 13572

|

| Label |

Description |

Base SF |

Total SF |

| A |

OFFICE-AVG QLTY |

590.00 |

590.00 |

| B |

OFFICE-AVG QLTY |

1313.00 |

1313.00 |

| C |

PORCH |

51.00 |

51.00 |

|

|

|

|

|

| Map Acres |

0.06 |

| Tax District Note |

141 - CNTY/CTY KINSTON/MUNI SVC |

| Present-Use Info |

COMM - IMP |

| Zoning Code |

|

| Zoning Desc |

|

|

| Total Improvements Valuation

|

*Total Improvements Full Market Value $

|

**Total Improvements Assessed Value

|

80,920

|

80,920

|

*

Note - Market Value effective Date equal January

1, 2017, date of County’s most recent General

Reappraisal

** Note - If Assessed Value not equal Market Value then variance

resulting from formal appeal procedure |

|

| Land

Value Detail (Effective Date January 1, 2017, date

of County’s most recent General Reappraisal) |

Land

Full Value (LFV) $

|

Land

Present-Use Value (PUV) $ **

|

Land

Total Assessed Value $

|

2,904

|

2,904

|

2,904

|

| **

Note: If PUV equal LMV then parcel has

not qualified for present use program |

|

| Land

Detail (Effective Date January 1,

2017, date of County’s

most recent General Reappraisal) |

Rate Type |

Rate Code |

Description |

Quantity |

|

|

|

|